We'll be in touch soon.

Write off up to 81% of your debt.

- Uses Government Legislation

- Stops all Interest & Charges

- Reduces Monthly payments to as little as £100 per month

- Consolidate debts over £3000

No Obligation, Confidential Debt Advice

Are You Eligible?

Could you write off up to 81% of your debt?

Some Of The Debts We Can Help With

Credit Cards

Personal Loans

Payday Loans

Overdrafts

CCJ Debts

Shopping Debts

Tax Arrears

Utility Arrears

If you're having problems with any of these types of debt, we have several solutions that might help.

We Can Help With These Creditors, And More!

Solutions We Offer

We have a number of ways to consolidate your debts in to one place, reduce your monthly repayment to an affordable amount and get breathing space from your creditors – so they can’t keep calling, texting or emailing you!

We know it can be daunting understanding these options and choosing which one best suits you, so our expert advisors are on hand to help you understand your financial position, answer all your questions and guide you through each of the options.

Debt Arrangement Scheme

Reduce your repayment, repay your debt in full with interest and charges frozen. Your home and all other assets are excluded from the process. Will impact your credit file for at least 6 years. The plan can fail if you breach any of the standard conditions.

Protected Trust Deed

One, affordable payment each month for four years. Any outstanding debt is written off at the end of the process. Usually you are able to protect your home. Homeowners should discuss this in detail with an advisor. Creditors get to vote on the proposal, so they may reject it if they feel it's unreasonable. Affects your credit file for 6 years.

Sequestration

Pay what you can afford for four years and any assets, including your home, may be sold to help pay your debts. Outstanding balances are written off. Certain restrictions apply and some debts are not written off. Affects your credit file for 6 years.

Minimal Asset Process

A form of sequestration for those in most need of debt write off. Pay a one off application fee and debts written off in 6 months. Homeowners and those with assets over £1k or a monthly disposable income, do not qualify. Certain restrictions apply, you remain under acquirenda for 4 years. Affects your credit file for 6 years.

Real World Examples

Possible Benefits

Debts Written Off

Up to 81% of your debt written off in less than 60 months.

Reduce Your Repayments

Reduce your monthly payment to one affordable amount each month.

Stop Creditor Contact

Creditors are not allowed to contact you, and cannot take further action against you.

Freeze Interest/Charges

Creditors cannot add any more interest or charges to your debt.

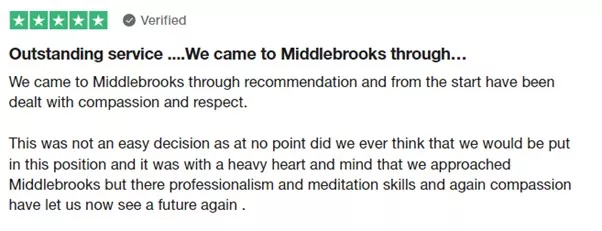

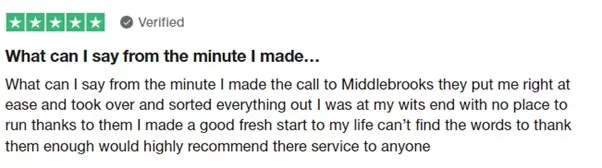

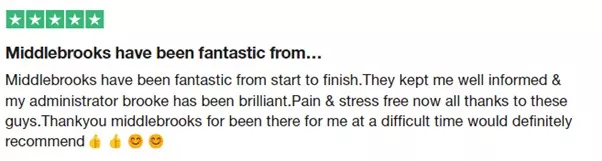

You're in good hands

Your car and home

Licensed Insolvency Practitioners

Understand your options same day